10 reasons why your practice should consider an EOT

Learn about Employee-Owned Trusts (EOT) and trusts in general in this article written by Michael Holmes, Associate Director at Whitemoor Davis, one of our specially chosen accountancy firms.

What are trusts?

A trust is simply a way of holding an asset on behalf of someone without them being in control of the asset. Trusts have been around for centuries in UK law; they are believed to have originated during the Crusades of the 12th century. The basis goes like this:

- a landowner (think large estate) would go to the Middle East and leave their land in the ownership of someone they trusted to look after and receive the rents

- as with all things, the new owners would not readily return the land to the owner upon their return from the Crusades, so the original owner had to petition the king to get their land back

- the Lord Chancellor always ruled in favour of the original landowner and hence the terms holding in “trust” on behalf of a “beneficiary” (original landowner)

Nowadays, trusts are used to hold pension assets, life insurance assets, and for MP’s to hold their businesses whilst they serve in the House of Commons.

Unfortunately, trusts have a bad reputation as they do have a lot of tax advantages. Some professional advisors have been using offshore trusts to assist their wealthy clients in avoiding paying their rightfully owed UK taxes.

EOTs are different from this, they have a completely legal tax mitigation structure and there is absolutely no need to set them up offshore to get the tax advantages. The government encourages EOT companies by giving tax incentives, much as they do for research and development expenditure with the R&D tax credit scheme. EOTs were explicitly set up by the government in the 2014 Finance Act to have tax advantages.

Watch the video below on how to set annual cost rates

What is an EOT?

As discussed on the succession planning for your practice page, it can be difficult to sell your business when you are ready to do so. All of the routes to exit are difficult to achieve and it can seem as though you will not be able to sell the business at all.

The government under David Cameron and Nick Clegg realised that this was a real problem for all businesses, not just architects, and therefore set up a review to investigate how they could make it more attractive for owners to sell their businesses to their employees. The review was called the Nuttall review - after Graeme Nuttall the lawyer who carried it out.

The basic outcome of the review that looked into why very few businesses used employee ownership as an exit strategy was:

- They are not publicised and hence there is a lack of awareness

- They are seen as complex, costly, and difficult to create and administer

- There were no incentives for an owner to sell to a trust instead of on the open market

The government accepted the Nuttall review in its entirety and decided that it would promote employee ownership as a useful means to deal with the succession issues within many businesses. This promotion came in the form of offering tax relief for employees receiving profit shares and for owners selling their business into an EOT.

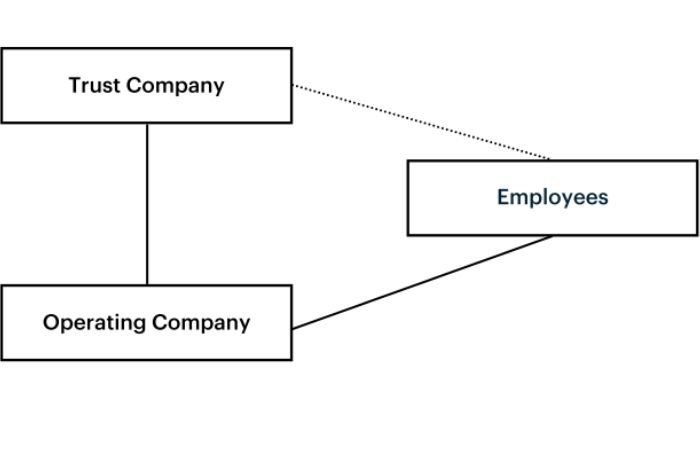

Within an EOT, the business sets up a new trust company that buys the shares from the shareholders and holds them in trust on behalf of the beneficiaries of that trust. The beneficiaries are the employees of the business. Employees do not normally own shares under an EOT.

The operating company continues to trade as it did before the transfer of ownership.

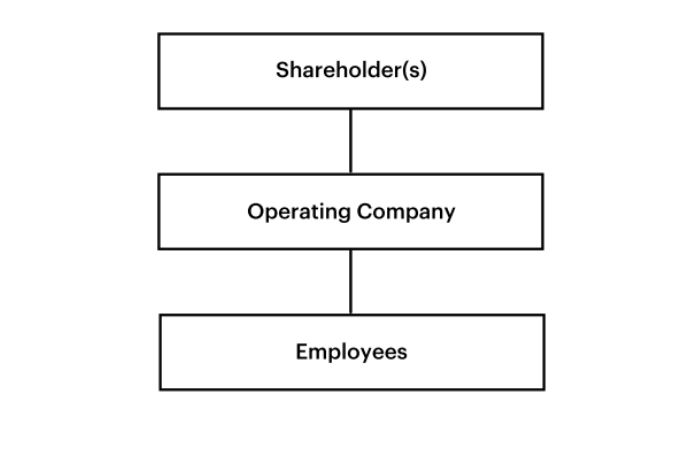

Structure before an EOT

Structure after an EOT

10 reasons why your practice should convert to an EOT

- All proceeds on the sale of the shares into an EOT are tax-free under legislation introduced in the Finance Act 2014. Currently, if a shareholder sells their shares in any other way, they are due to pay Capital Gains Tax on the proceeds. Sale to an EOT completely removes the tax from the sale.

- Employees are able to receive the first £3,600 per annum of profit share completely free of Income Tax. (National Insurance still applies).

- The company can continue to operate exactly the same way it did before the sale, i.e. with the same board and management structure in place.

- Promotion to the board can be done entirely on merit and not on the ability to buy shares in the business.

- Ownership is removed as a barrier to the continuation of the business for the life of the trust (historically 99 years).

- It provides a more flexible exit strategy as the ex-shareholders are free to remain in the business as much or as little as they wish.

- As the company is effectively buying itself on behalf of the employees, payments to the shareholders can be made flexible over a period of time to ease the trading company’s cash flow issues.

- Employees will generally get more say in the operating of the business which usually leads to increased profitability. It is important to note that the employees do not run the business. The Board of Directors retains their responsibility to run the business as they did before. However, they are expected to communicate with and have regard for the views of the employees. Directors do not have to follow the views of the employees.

- Employees have the right to share in the profits in a fair manner (set out in legislation) if a profit share is declared.

- The culture of the business tends to remain the same as the same managers are running the business as before the sale.

Key considerations

Whilst EOTs are a very attractive proposition for owners of architectural practices looking to make an exit, they are not suitable for everyone. As with all things, there are two disadvantages to the EOT route:

- The company is effectively buying itself which means that the shareholders do not get paid immediately. It can take many years for the final sums to be paid, during which time the shareholders are (to a certain extent) at risk as payments are dependent on the underlying profitability of the operating company.

- The money that is used to pay the shareholders comes out of profits and hence is money that could have been used to pay (taxable) dividends to the shareholders. For this reason, the EOT may not be suitable for younger owners of businesses who are giving up too many years of dividends. This should be balanced against the motivational benefits to staff of the EOT structure. Studies indicate an increase in profitability of up to 15% after conversion to an EOT.

If you wish to sell your business into an EOT it is best if you obtain an independent valuation of your business from a professional.

Whilst the points outlined in this paper are good general points, it is important that you take independent advice from accountants and lawyers to fully consider the EOT route.

At Whitemoor Davis we have helped many businesses convert to an EOT, such as TateHindle Architects. We would be happy to have a confidential discussion with any practice.

Success story – TateHindle Architects

TateHindle Architects were owned by two shareholders, Andrew Tate and Jim Hindle. Andrew and Jim had been looking at their possible exit strategies for many years but were not able to find a way to sell the business, either externally or internally to the next generation of directors. As Andrew Tate says:

“At TateHindle we had been struggling with succession for a long time. We had discussed an external sale and an internal sale to the next generation, along with other options, but for various reasons none of these were suitable.

When we were first presented with the option of converting to an EOT, my fellow shareholder and I felt that this had some clear advantages for us. The option of converting to an EOT enabled us to set up an employee council giving employees a voice in the business.

Understanding the attitude of the staff helps the board make more informed decisions about important business issues. Placing the shares into trust, on behalf of the employees, allows everyone to share in the profits which we believe is a good way to reward our employees, many of whom have been with us for a long time.

The sale of the business to a trust has also allowed us to receive payment for our shareholding over several years, tax-free.”

TateHindle converted just over five years ago, and the shareholders have been fully paid in accordance with the schedule agreed at the commencement of the EOT. As Andrew says:

“When we first sold our shares to the EOT we were concerned that most of the money due to us would be paid out over several years. Although we had a contract in place with the Trust Company, the payments could only be made if the operating company made sufficient profits. Due to everyone’s hard work, we have now completed all payments in accordance with the original schedule.”

Now that TateHindle has fully paid up the ex-shareholders they are looking forward to being able to reward the employees more fully out of the profits of the business. Andrew again:

“Now that we are a fully paid up EOT, we are looking forward to being able to share more of the benefits of employee ownership with our colleagues. The business will be able to declare profit shares in an equitable manner to all our employees. We have already seen the benefits of employees being stakeholders in the business and we will continue to enjoy building communications throughout TateHindle.”

To sum up, EOTs can be an attractive route to exit for owners of architectural practices and we recommend them to many of our clients. However, they are not suitable for everyone and, as previously advised, you must take proper professional advice before setting out on the journey to employee ownership through an EOT.

If you would like further details on EOTs or would like to arrange a conversation, you can contact RIBA Business at business@riba.org.